XRP Price Prediction: Technical and Fundamental Analysis for 2025

#XRP

- Technical Positioning: XRP trading below 20-day MA but showing bullish MACD divergence suggests potential reversal pattern

- Fundamental Catalysts: SWIFT integration, BlackRock ETF consideration, and derivatives market expansion provide strong growth drivers

- Risk Management: Current price near Bollinger Band support offers favorable entry point with defined risk parameters

XRP Price Prediction

XRP Technical Analysis

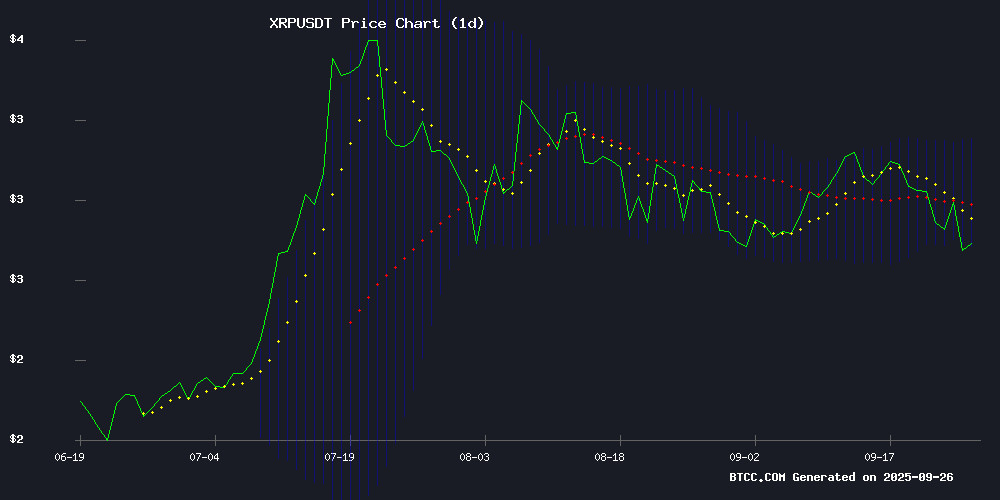

XRP is currently trading at $2.8006, below its 20-day moving average of $2.9672, indicating potential short-term bearish pressure. The MACD shows a positive histogram of 0.0678, suggesting building bullish momentum despite the signal line remaining negative. Bollinger Bands position the price NEAR the lower band at $2.7651, which could act as support. According to BTCC financial analyst Emma, 'The technical setup shows mixed signals with the price below MA but MACD turning positive. A break above the 20-day MA could trigger upward movement toward the upper Bollinger Band at $3.1694.'

Market Sentiment Analysis

Recent news headlines reflect cautiously optimistic sentiment for XRP. The SWIFT payment system upgrade and BlackRock's potential ETF consideration provide fundamental support, while analyst predictions of a 'final retracement before major rally' suggest positive medium-term expectations. BTCC financial analyst Emma notes, 'The news FLOW aligns with technical indicators showing potential consolidation before upward movement. Institutional interest from firms like BlackRock and Ripple's positioning in the derivatives market could drive significant price appreciation if technical resistance levels are broken.'

Factors Influencing XRP's Price

Ripple’s XRP Positioned for Growth as SWIFT Launches Faster Payment System

SWIFT's latest upgrade aims to revolutionize cross-border retail payments, targeting domestic transaction speeds and reliability. Partnering with major banks, the initiative sets stringent performance benchmarks for settlement times, cost efficiency, and transparency.

Ripple's On-Demand Liquidity platform, leveraging XRP, aligns seamlessly with SWIFT's objectives for accelerated and predictable settlements. While SWIFT hasn't explicitly endorsed cryptocurrencies, the announcement opens strategic avenues for Ripple's technology in global payment infrastructure.

Market observers interpret this development as a tacit validation of XRP's utility in institutional finance. "The convergence of traditional banking networks with blockchain solutions is inevitable," noted a payments analyst, highlighting Ripple's potential to bridge legacy systems and decentralized finance.

XRP Weekend Forecast and Weekly Recap

XRP faces a critical weekend as traders brace for volatility following a week of price declines. The digital asset struggled to hold above the psychologically significant $3.00 level, setting the stage for potential breakout or breakdown scenarios.

Technical indicators suggest a narrow trading range between $2.70 support and $3.00 resistance. Market participants are closely monitoring trading volume spikes and sentiment shifts that could signal either a bullish reversal or accelerated selling pressure.

The failed rally attempt this week underscores the ongoing battle between XRP bulls and bears. A confirmed breakout above $3.05 could open the path to $3.35, while failure to maintain $2.70 support may trigger cascading liquidations.

BlackRock Weighs Key Factors for Potential XRP ETF Launch

BlackRock, the world's largest asset manager, is evaluating critical considerations that could pave the way for a spot XRP exchange-traded fund. Robbie Mitchnick, Head of Digital Assets at the firm, revealed these insights during a discussion with ETF analyst Nate Geraci.

The move signals growing institutional interest in XRP as a viable asset class, following the success of Bitcoin and Ethereum ETFs. Market participants now await further clarity on BlackRock's decision-making framework.

Ripple CTO David Schwartz on DeFi’s Future and Tokenized Assets

Ripple CTO David Schwartz envisions a financial landscape where decentralized finance (DeFi) and traditional finance (TradFi) coexist harmoniously. Blockchain technology, he argues, is the driving force behind this evolution, enabling innovations that traditional systems cannot match.

Tokenized real-world assets—such as loans and real estate portfolios—are poised to play a pivotal role in DeFi's growth. Schwartz highlights decentralized exchanges as critical infrastructure for reshaping financial products and services.

Blockchain's neutrality, according to Schwartz, is its greatest asset for institutional adoption. Companies like Amazon and Uber demand advanced financial solutions that only blockchain can deliver, signaling a broader shift toward decentralized systems.

XRP Price Outlook as Analyst Predicts Six-Year Dominance Peak

XRP may be poised for a resurgence as market analysts forecast its dominance reaching levels unseen since 2018. The prediction comes amid broader crypto market weakness that has dragged down most digital assets, including Ripple's native token.

While recent price action has reflected sector-wide pressures, technical indicators suggest XRP could break from the pack. The projected surge in dominance metrics often precedes significant price appreciation, potentially setting the stage for new all-time highs.

Gemini Highlights XRP's 5-Year ROI Amid Crypto Performance Review

Gemini, the U.S.-based cryptocurrency exchange, has spotlighted XRP's staggering returns over a five-year horizon. A $1,000 investment in the token would have yielded significant gains, according to the platform's comparative analysis of major digital assets.

The exchange's social media post contrasted XRP's performance against other cryptocurrencies, though specific metrics were not disclosed. This retrospective view emerges as institutional interest in crypto ROI metrics intensifies.

XRP Commentator Opts for Security Over High-Yield Offerings

Digital Asset Investor (DAI), a prominent voice in the XRP community, has publicly declined participation in current yield offerings promising 8–10% annual returns. The commentator emphasized a preference for security over speculative gains, stating he would willingly sacrifice 3–5% of potential yield for insured custody solutions.

Market observers note this stance reflects growing institutional caution in crypto yield products. While the tweet didn't specify providers, the commentary highlights an emerging divide between retail yield chasers and risk-averse participants seeking traditional financial safeguards.

XRP Potential Surge Tied to RLUSD's Entry into $189T Derivatives Market

Ripple's XRP could see significant upside if its stablecoin RLUSD gains access to the $189 trillion U.S. derivatives market. The opportunity stems from a new initiative by the Commodity Futures Trading Commission (CFTC), which may create a regulatory pathway for crypto-based derivatives.

Market analysts highlight the symbiotic relationship between XRP and RLUSD, noting that Ripple's established infrastructure positions it uniquely to capitalize on this development. The CFTC's move signals growing institutional acceptance of cryptocurrency derivatives, with ripple effects across the digital asset ecosystem.

Analyst Predicts XRP Final Retracement Before Major Rally

Market analyst CasiTrades suggests XRP is nearing the end of its corrective phase, with a significant bullish wave poised to follow. The digital asset, long watched for its explosive potential, may soon resume its upward trajectory toward new highs.

Technical indicators point to a final low being established before Wave 3 acceleration begins—a pattern that historically precedes substantial price appreciation in cryptocurrency markets. This development comes as traders increasingly position for altcoin season.

Arc Miner Launches XRP Cloud Mining Contracts Amid Market Optimism

XRP has gained 1.6% in the past 24 hours, reclaiming critical support levels as bullish sentiment builds. The rally coincides with the debut of Ripple USD (RLUSD) and the first XRP spot ETF, driving institutional demand.

Arc Miner capitalizes on this momentum with new cloud mining contracts promising daily yields of 3,000 XRP. Technical analysis suggests XRP could rebound toward $3.60—or even $5—making these contracts attractive for both miners and long-term holders.

The platform offers tiered investment options, from a free $15 trial to premium $100,000 packages, with returns scaling proportionally to commitment. Registration includes a $15 bonus, yielding $0.60 daily.

XRP Faces Pivotal Price Moment Amid Technical Divergence

Ripple's XRP struggles at a critical resistance zone between $2.65 and $2.70 after declining 3% daily and 9% weekly. The cryptocurrency's $8.66 billion trading volume reflects heightened volatility as analysts debate whether this marks a consolidation before breakout or the start of deeper correction.

Technical analyst EGRAG crypto frames the situation as a binary outcome: "Are we going to pump down to $3.20 or crash up to $2.20?" The descending triangle pattern suggests imminent resolution, with a daily close above $2.70 potentially triggering a rally toward $3.20, while rejection could spark renewed selling pressure.

Divergence emerges among market observers. CoinsKid interprets the price action as a complex Wave 4 correction following June's explosive rally, noting "monumental support" beneath current levels. The analysis highlights three lower highs compressing against key support—a textbook setup preceding significant volatility.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment opportunity with measured risk. The cryptocurrency is trading at $2.8006 with several positive catalysts on the horizon.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $2.8006 | Below 20-day MA, potential buying opportunity |

| 20-day Moving Average | $2.9672 | Key resistance level to watch |

| MACD Histogram | +0.0678 | Bullish momentum building |

| Bollinger Band Position | Near lower band | Potential support zone |

BTCC financial analyst Emma suggests, 'XRP's current positioning below the moving average combined with positive MACD divergence creates an attractive risk-reward scenario. The fundamental developments around SWIFT integration and potential ETF approval provide additional upside catalysts. Investors should monitor the $2.9672 resistance level for confirmation of upward momentum.'